who pays sales tax when selling a car privately in texas

Motor vehicle sales tax is the purchasers responsibility. If as a resident of Texas you sell a car to someone in another state any sales tax is up to the buyer.

Nj Car Sales Tax Everything You Need To Know

However you do not pay that tax to the car dealer or individual selling the.

. If you own a car whether you purchased it new from a dealer or used from a private seller theres a 99. Once the buyer has the vehicle. When Who pays sales tax when selling a car privately in Texas.

If buying from an individual a motor vehicle sales tax 625 percent on either the purchase price or standard presumptive value whichever is the highest value must be paid when the vehicle. It is a bit different selling a car in Texas from some other states. Yes you must pay vehicle sales tax when you buy a used car if you live in a state that has sales tax.

If the seller is not a Texas licensed dealer the purchaser is. Who pays sales tax when selling a car privately in Texas. While this question might seem a little complicated the answer is very straightforward and the simple answer is you dont have to pay taxes.

Motor vehicle sales tax is the purchasers responsibility. When Who pays sales tax when selling a car privately in Texas. There are two certainties in life as the saying goes.

If the buyer is living in another state then the tax would need to be paid in. Car Sales Tax on Private Sales in Taxes. If the seller is not a Texas licensed dealer the purchaser is responsible for titling and registering the vehicle as well as paying the.

Who pays sales tax when selling a car privately in Texas. You do not need to pay sales tax when you are selling the vehicle. Driving in Back Bay ShutterstockRelated GuidesSales and Use TaxMotor Vehicle ExciseFeedbackDid you find what you were looking for on this webpage.

Motor vehicle sales tax is the purchasers responsibility. The sales tax on the car is 62 of the price or how much the car is worth whichever is higher. If I sell my car do I pay taxes.

If the seller is not a Texas licensed dealer the purchaser is. Required Yes N. Private car sales are still taxed 625 in Texas but it is calculated from the purchase price or standard presumptive value SPV whichever is higher.

If as a resident of Texas you sell a car to someone in another state any sales tax is up to the buyer. Multiply the vehicle price after trade-in andor incentives by the sales tax fee.

Texas Vehicle Sales Tax Fees Calculator Find The Best Car Price

Does The Seller Have To Pay Tax On A Vehicle When He Sells It

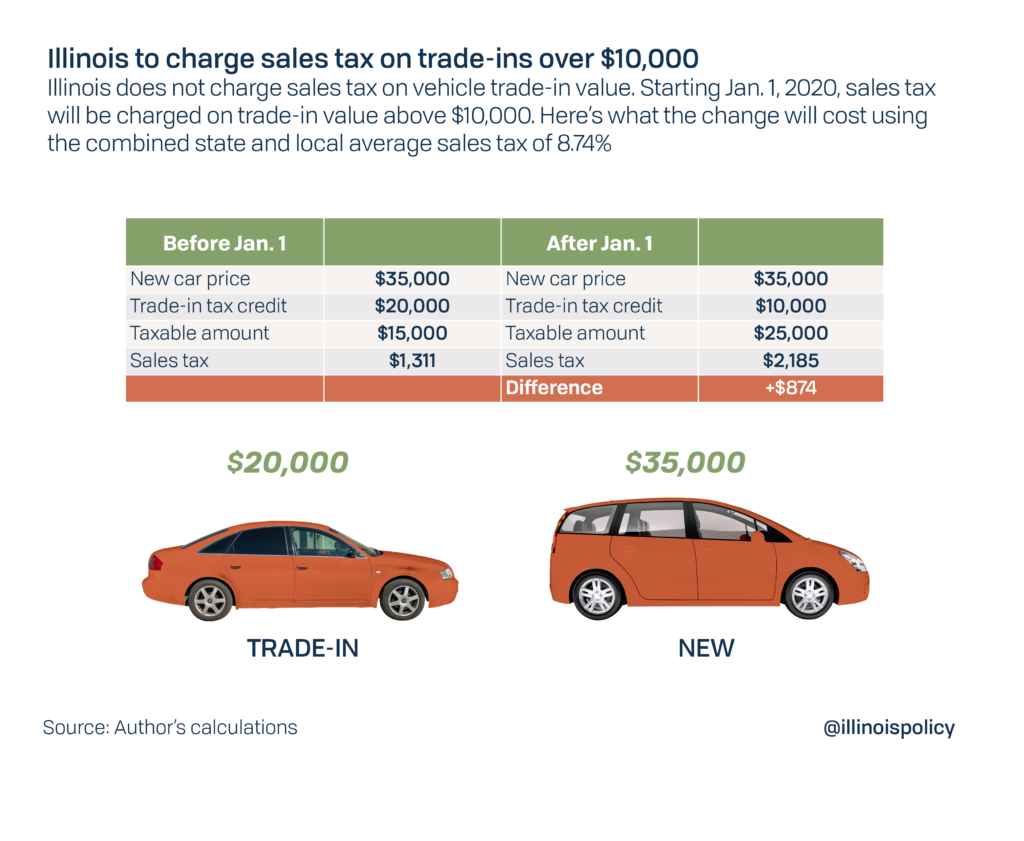

Illinois Imposing Car Trade In Tax On Jan 1 Dealers Call It Double Taxation

Oregon Bills Of Sale Templates Forms Facts Requirements For Selling Car Boat

7 Ways To Protect Yourself When Selling A Car Kelley Blue Book

All About Bills Of Sale In Ohio Forms Templates Facts Etc

Is Buying A Car Tax Deductible Lendingtree

Understanding Taxes When Buying And Selling A Car Cargurus

Selling A Car In Texas Privateauto

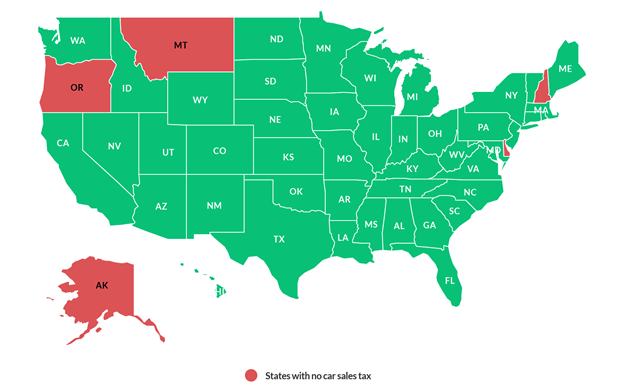

Sales Tax Laws By State Ultimate Guide For Business Owners

Understanding California S Sales Tax

Texas Vehicle Sales Tax Fees Calculator Find The Best Car Price

/images/2022/02/08/woman_in_car.jpg)

How To Legally Avoid Paying Sales Tax On A Used Car Financebuzz

Selling Your Car Privately Or To A Dealer What S Better Orr Chevrolet Of Fort Smith Blog

How To Charge Your Customers The Correct Sales Tax Rates

What To Know About Taxes When You Sell A Vehicle Carvana Blog